By Clark Corbin, Idaho Capital Sun

October 10, 2025

The latest budget documents released by the state show Idaho is projected to end the current fiscal year in June with an unconstitutional state budget deficit of $56.6 million dollars.

The projected $56.6 million state budget deficit was calculated in the October Fiscal Year 2026 Budget and Revenue Monitor report, which the Idaho Legislative Services Office released Friday.

The Idaho Constitution prohibits the state from running a budget deficit where expenses exceed available revenue.

However, the state’s top budget official told the Idaho Capital Sun late Friday afternoon that Gov. Brad Little will do what needs to be done to ensure the fiscal year 2026 budget balances.

Little already ordered all state agencies – other than public schools – to cut their budgets by 3% before the end of the fiscal year June 30. A short time later, Little said those cuts will continue into 2027 and be made permanent.

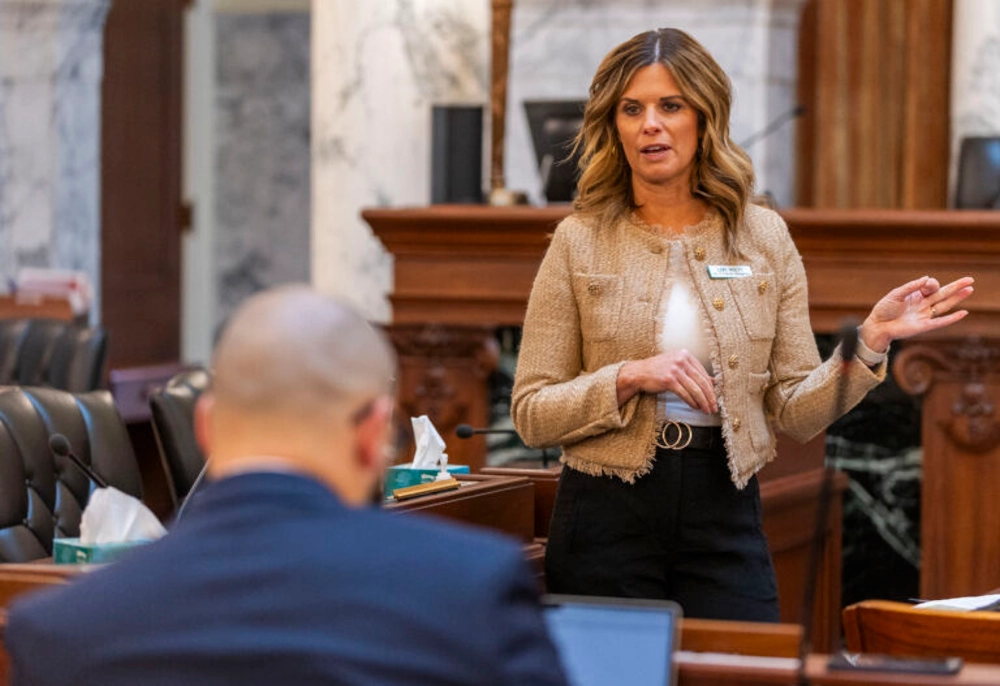

No decisions have been made, but state officials are discussing the possibility of additional cuts and deeper cuts, said Lori Wolff, administrator of the Idaho Division of Financial Management.

“Obviously we are watching this very closely and talking amongst the governor’s office staff about what we need to do to make sure we submit a balanced budget,” Wolff said. “We’ve already done the 3% holdbacks and are starting to examine other places where we may need to reduce expenses.”

House Minority Leader Ilana Rubel, D-Boise, said the state budget situation is an irresponsible mess created by Republicans reducing revenue through tax cuts and passing the new education tax credit. She said the 3% budget holdbacks and the 4% cut Medicaid reimbursement rate cuts have already hurt low income and sick Idahoans.

“Our budget problems have barely begun. We are in a deep, deep hole right now,” Rubel said late Friday. “We’re now past the point where people can write it off as some sort of (budget) glitch. We knew there were problems, and we shouted from the mountaintops that the state couldn’t afford these massive revenue cuts. Now every passing month is confirming it is a huge problem with very real consequences.”

Wolff said budget officials will brief Little this month and then he will prepare his gubernatorial budget request in November.

Wolff said Little and the Division of Financial Management are committed to doing what it takes to avoid a budget deficit of any kind.

“We are continuing to watch revenues and make decisions to make sure whatever we submit is a balanced budget,” Wolff said. “At the same time we don’t want to overreact. This may correct itself, and we definitely don’t want to put too much weight into one month of revenue.”

Idaho runs on a fiscal year calendar that begins July 1 and ends June 30. The October budget and revenue report covers the first three months – or first quarter – of the current fiscal year 2026.

In simple terms, revenue is the amount of money available to spend on expenses in the state budget. The largest source of revenue is taxes.

Through the first three months of fiscal year 2026, revenues have come in $94.1 million, or 6.8%, below the revised revenue forecast issued by the Division of Financial Management, the new budget and revenue monitor report shows.

The revenue shortfalls are occurring after the Idaho Legislature and Little reduced revenue by more than $450 million during the 2025 legislative session to pay for tax cuts and a new education tax credit that reimburses families for eligible education expenses, including tuition at private religious schools.

News of a projected budget deficit is a big change for Idaho.

A little over three years ago, Idaho ended fiscal year 2022 with a record state budget surplus estimated at $2 billion.

The budget picture has even changed considerably since legislators adjourned the 2025 legislative session April 4, when they projected ending fiscal year 2026 with a positive ending balance of $439.8 million.

But in the six months since legislators adjourned the session, that $439.8 million surplus has now become a projected deficit of $56.6 million, according to the October Fiscal Year 2026 Budget and Revenue Monitor report.

The projected $56.6 million deficit does not include the cost of adopting the tax changes from the federal One Big Beautiful Bill Act that President Donald Trump signed into law this summer. The nonprofit Tax Foundation estimated it could cost Idaho and additional $167 million to conform to the individual tax changes, which include no tax on workers’ tips and no tax on workers’ overtime. Rubel said Friday it could cost Idaho even more to adopt all of the tax changes from the One Big Beautiful Bill.

Wolff emphasized that the state’s overall economy remains strong and rainy day budget reserve accounts are sitting at record levels. Wolff also pointed out that Idaho State Treasurer Julie Ellsworth announced Thursday that the financial investor services firm Moody’s Ratings just affirmed Idaho’s AAA credit rating.

Idaho is not the only state grappling with revenue shortfalls. The Colorado Legislature called a special legislative session this summer, in part to address shrinking revenue, Colorado Newsline reported. Meanwhile, the Washington State Standard reported that state tax revenue in Washington is down by $500 million.

Idaho Capital Sun is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Idaho Capital Sun maintains editorial independence. Contact Editor Christina Lords for questions: info@idahocapitalsun.com.