By Representative Steve Berch

In December of 2019, I wrote an op-ed titled, “The Fiscal Elephant in the Room.” It detailed how the Idaho Legislature was exempting an estimated $2.5 billion from revenue collection every year in the form of sales tax exclusions that never get reviewed and never expire. It turns out the $2.5 billion figure was wrong.

In December of 2019, I wrote an op-ed titled, “The Fiscal Elephant in the Room.” It detailed how the Idaho Legislature was exempting an estimated $2.5 billion from revenue collection every year in the form of sales tax exclusions that never get reviewed and never expire. It turns out the $2.5 billion figure was wrong.

What you’re about to read is perhaps the most important challenge – and opportunity – facing the Idaho Legislature that few people know about. As the 2023 legislative session consumes itself with bills about books, guns and re-writing Webster’s dictionary, Idahoans would be better served if the legislature revisited the Fiscal Elephant in the Room.

“You can’t handle the truth!”

That famous line was delivered by Jack Nicholson as Marine Colonel Nathan Jessup in the movie “A Few Good Men.” It summarizes a fiscal truth here in Idaho that the legislature refuses to acknowledge or is incapable of handling. That truth is this: The Idaho Legislature has been committing fiscal malpractice for decades – at your expense.

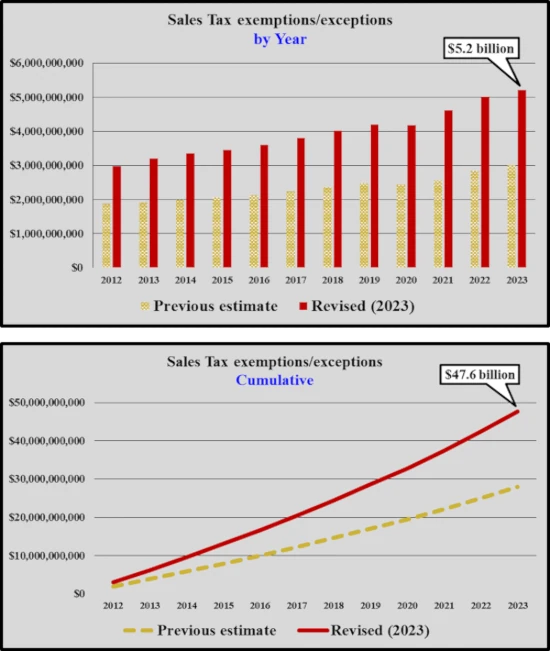

But don’t take my word for it – let’s look at the latest numbers from the state’s Legislative Services Organization (LSO). Below are two graphs that quantify the amount of sales tax revenue the legislature excluded from collection each year since 2012. The first graph shows these exclusions by year, comparing LSO’s previous estimates (yellow) with the 2023 revised estimates (red). The second graph shows the cumulative dollars excluded accordingly. The result:

• $5.2 billion is now being excluded annually.

• $47.6 billion has been excluded since 2012.

$47.6 BILLION!

If only 10-percent ($4.7 billion) of those cumulative tax breaks had expired due to obsolescence or could no longer be justified, the state would have the revenue for several of its financial responsibilities –which still have to be paid for:

If only 10-percent ($4.7 billion) of those cumulative tax breaks had expired due to obsolescence or could no longer be justified, the state would have the revenue for several of its financial responsibilities –which still have to be paid for:

• Over $1 billion in deferred or ignored public school building maintenance. This is the legislature’s constitutional obligation.

• Over $500 million in basic road and bridge maintenance (and more for new construction).

• Over $500 million for a new state prison.

• Millions of dollars to provide vital services (including healthcare) for a rapidly growing population.

But wait, there’s more!

In 2021, the Office of Performance Evaluations (OPE) released a report titled Designing a Review of Tax Preferences that summarized a variety of tax breaks (called “preferences”). A 24-page Supplemental Report provided the basis for LSO’s revision of its calculations.

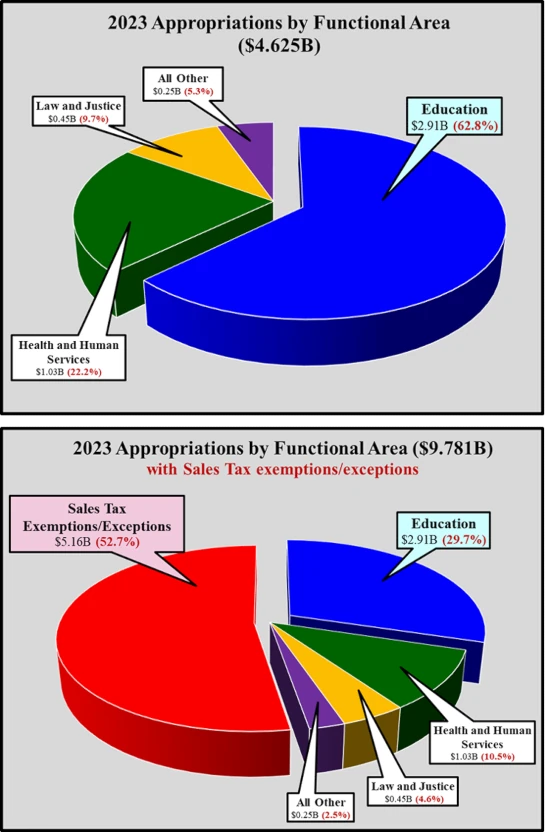

The following pie charts put the magnitude of these tax breaks in perspective. The top chart shows the current 2023 budgets for key functional areas based on the $4.6 billion in revenue the legislature chose to collect. The bottom chart adds the additional $5.2 billion in sales tax revenue into the pie chart that the legislature chose not to collect.

Note how education drops from 62.8-percent of the budget to only 29.7-percent when considering the sales tax revenue taken off the table before budgets are set. The legislature is now exempting more in sales tax exclusions than it collects for everything else – and this doesn’t include other tax breaks for property and income tax.

This doesn’t mean that these sales tax exclusions are wrong or bad – most of them may be justifiable and should remain in place. What is wrong and bad is this:

• They are never reviewed.

• They never expire (some have been in place since the 1960s).

• There is no objective criteria for determining if a tax break is a net long term benefit to the citizen of Idaho or has become a gift to the recipient.

Consider this: if a review process determined that only 20-percent of sales tax exemptions are obsolete or no longer make business sense, over $1-billion would be added to the general fund each year! We’d have the revenue to meet the state’s responsibility to adequately fund education, infrastructure and vital services. And . . .

Consider this: if a review process determined that only 20-percent of sales tax exemptions are obsolete or no longer make business sense, over $1-billion would be added to the general fund each year! We’d have the revenue to meet the state’s responsibility to adequately fund education, infrastructure and vital services. And . . .

Your property taxes would go down. School districts wouldn’t have to float bonds and levies every year to hire enough teachers to keep classes sizes below 40 students or keep the roof from falling in on their heads. Even if a review process determined that only five percent of sales tax exclusions should expire, that alone would make an additional $250 million available for schools each year, or over $1 billion every four years.

The government that governs least . . .

There are several reasons this issue continues being ignored:

• There is an army of lobbyists in the Capitol to protect their tax breaks.

• When every member of the legislature is up for re-election every two years, it is very difficult to address long-term problems, especially tax policy.

• Legislators are afraid of being attacked for “raising taxes,” even if a tax break no longer makes sense.

Perhaps the biggest reason for inaction is that the majority party has become a victim of its own simplistic ideological slogans – especially the one that says “The government that governs best governs least.” Do you know what governments govern least?

Third-world countries.

The government that governs least does the least – for you. It’s not a question of big or small. The government that governs best governs smart. We have to be smart with tax payer dollars every day, but we have to balance that with smart investments for the future – especially for the fastest growing state in the nation.

No organization in the public or private sector ever thrived or even survived simply by cutting costs – it is a path to nowhere. We make these balanced decisions in our personal life all the time (when we can): buying a home instead of renting, investing in college for our children, spending money on leisure activities to strike a livable work/life balance, and so on.

If we’re going get Idaho’s fiscal house in order for our children’s future, we’re going to need a few good men – and women – in the legislature brave enough to step up and deal with this growing fiscal elephant in the room.

Rotunda Roundup

It’s an election year and the legislature is being flooded with bills designed to inflame and agitate a small, targeted group of voters that can determine the outcome of a low-turnout primary election. Most legislative candidates don’t have a challenger in the November election, so if they win in May they automatically win in November.

What’s deceptive about many bills is that they often have good-sounding titles but are terribly flawed. It is disheartening to watch some legislators provide a long list of reasons why a bill is bad, but still vote for it. That’s why my newsletters are often very long. It’s important that you know not only how I voted, but more importantly why I voted the way I did. I expect to be voting against a lot of bad bill with good-sounding titles this session.

NOTE: You can look up any bill mentioned below by clicking here.

Criminal penalties related to fentanyl (H406 – passed the House, in the Senate). This bill adds Fentanyl to the list of drugs that carry mandatory minimum sentences. It defines the amount of fentanyl that is required to meet the elements for the crime of trafficking. It also adds provisions for the crime of drug induced homicide.

We must do something about the scourge of illegal fentanyl. But doing “something” doesn’t mean doing “anything.” This bill replaces judicial discretion with prosecutorial discretion. A college student who is in the wrong place at the wrong time could be sent to jail for life. This bill is touted as a deterrent to crime, but addiction is immune to deterrence.

If this bill did a better job of distinguishing between a manufacturer, dealer, trafficker and user of fentanyl, differentiating between adults and minors, and changed how it calculates the actual quantity of illegal fentanyl, I would have voted for this bill. I voted against this bill as it is currently written. I would like to vote for a fentanyl bill if the issues with this bill are corrected in the Senate.

Allow concealed guns in public schools (H415 – passed the House, in the Senate). School shootings are a terrible concern. Unfortunately, this bill is a terrible response to that concern. This bill allows anyone defined as a school employee to carry a concealed gun into any public or private school building. I voted AGAINST this bill for several reasons:

• This bill lets almost anyone take the law into their own hands: janitors, lunch ladies, bus drivers, grounds keepers and any non-paid volunteer who happens to be in the building.

• The concealed gun holder is required to complete only eight hours of limited training that requires absolutely no training for how to exercise judgment in a tense terrorist or hostage situation.

• The concealed gun carrier is immune from all civil or criminal prosecution no matter how many people they may kill when responding to a shooter. Not even trained law enforcement professionals get this level of immunity for their actions.

• This bill removes all local control over this decision. Current law allows school districts to do this, and a few in rural districts have enacted this type of policy where police response time can be lengthy. This bill forces every school district to allow concealed guns in the building, even if most parents are against it.

• Some insurance companies have indicated they will drop coverage if this bill becomes law.

But the most disturbing thing about this bill is the existence of the bill itself. It normalizes the notion that school shootings are now permanent, accepted part of life in schools. I refuse to concede that. Instead, we should focus on bills that help prevent the root cause of school shootings, such as mental health services, the ubiquitous availability of military grade assault weapons to almost anyone, improved law enforcement resources, etc.

Repeal Medicaid expansion (H419 – killed in committee). This is perhaps one of the most deceptive bills ever written. It was presented as a way to cut Medicaid costs by requiring the federal government to grant a list of exceptions to current law, such as requiring work requirements. If the federal government did not grant all these requested exceptions by 2025, this bill would then repeal Medicaid Expansion in its entirety here in Idaho. The sponsors knew that the federal government has never approved the exceptions being requested. These exceptions were used to hide the bill’s real purpose which was to repeal Medicaid Expansion.

The Health & Welfare committee voted 8-5 to hold the bill in committee, which stops it for now. However, the committee chairman can bring the bill back at a later date. I would have voted against this bill had it come to the House floor for a vote. Constituents have consistently told me at the door they support Medicaid Expansion. In fact, this issue was a significant factor in my first being elected in 2018.

Fine libraries if they have certain books on their shelves (H384 – held in committee). This bill is a slightly modified version of the library bill that was vetoed by Governor Little last year. The most notable change was that it reduced the fiscal punishment on libraries from $2,500 to $250 per incident. However, it left intact libraries having to pay attorney fees (which can be very high). A more serious problem with this bill (and last year’s version as well) is that insurance companies have indicated they may not provide insurance to libraries if this bill became law, which would effectively shut down libraries. That alone is a reason I would have voted AGAINST this bill. This bill never came up for a vote in the House because there is a competing bill in the Senate. We are waiting to see if there will be a new bill that is a compromise between this bill and the Senate’s bill.

Allow the Idaho Attorney General to prosecute local city and county officials (H390 – passed the House, in the Senate). This bill allows Idaho’s Attorney General Raul Labrador (and any future AG) to prosecute local elected officials if he doesn’t like what they are doing. Cities and counties already have prosecutors to pursue wrong-doing within their jurisdictions. This bill injects the heavy hand of the state into local government and violates the principle that government is best when it’s closest to the people. I voted against this bill, which is essentially a prosecutorial power grab by Raul Labrador. It is worth noting that this bill was written by Raul Labrador’s former law partner.

Accelerate Charter Schools Act (H422 – passed the House, in the Senate). I would have voted for this bill if it was simply a consolidation and clean-up of 26 years of charter school bills. But buried in this 36-page bill are several sections that made this really about “accelerating” charter school proliferation by private, out-of-state interests. This bill allows an unlimited number of charter schools to be placed under a single entity, which can act as a shell for a for-profit education service provider. It allows private interests to give charter schools an unlimited amount of money. It also takes away parent and teacher approval before transferring a charter from one private entity to another. Taken together, this bill allows outside interests to create a shadow statewide school district under the umbrella of just a few chartered school districts. It won’t happen overnight, but it will happen over time.

But what really revealed the true intent of this bill was a provision to completely remove the State Board of Education’s oversight of charter schools and give it to a new, separate governing body. This would essentially lay the groundwork for creating a separate, self-governing statewide education system. This provision was removed in the final version of the bill, but I expect it to come back in a future bill at a later date.

I support charter schools. Many of my constituents send their children to charter schools, and there are some really great ones here in the Treasure Valley. I support school choice – and there is a wide variety of choices that neither I nor anyone else in the legislature want to take away. However, the legislature’s first obligation is its constitutional responsibility to support a uniform public school system. I do not support policies that accelerate a preference for one choice at the expense of supporting the traditional public schools that serve over 90-percent of Idaho students. I voted against this bill because it sets the stage for undermining that constitutional responsibility.

Allow the Department of Fish & Game to not disclose certain information (H404 – passed the House, in the Senate). This bill amends existing law to provide an exemption from disclosing certain records regarding wildlife. Specifically, some people have requested access to GPS data that reveals the precise location of big game animals that have been tagged to study migration and other behaviors. This creates an “unfair chase” situation that runs counter to the spirit and intent of true big game hunting and sportsmanship. I voted for this reasonable, common sense bill.

In the hopper

Here are just some of the bills making their way through the legislature. Some of these bills may die along the way, and many new ones will start popping up as the legislature approaches the half-way point of the 2024 session. One issue I will address in a subsequent newsletter is the troubling changes being made to the budget setting process. I will wait to see how the dust settles before addressing this.

H396 – Prohibit all mask mandates.

H405 – Impose the death penalty on someone convicted of lewd conduct with a minor.

H421 – Redefining the word “gender” to be synonymous with the word “sex.”

H423 – Reinstate maternity mortality monitoring.

H426 – Restrictions on the use of Artificial Intelligence (AI) in political/election advertisements.

H447 – School voucher bill (called a “parental choice tax credit”).

H453 – Appoint State Board of Education members by geographical regions.

H470 – Create an ““Office of Elections Crimes and Security” within the Attorney General’s office.

S1220 – Redefine “domestic terrorism” to exclude domestic terrorists. Really.

S1228 – Allow concealed weapons on college campuses.

S1229 – Prohibit abortions for any and all instances of rape or incest.

S1234 – Provide insurance coverage that allows receiving up to a six month’s supply of contraceptives.

S1240 – Allows unorganized militias to parade in public with firearms.

S1249 – Creates “teacher spending accounts” to help offset out-of-pocket costs for teachers.

S1253 – Protect children from exposure to harmful material online.

S1261 – Limit the ability for state employees to work from home (telework).

S1273 – Require the Secretary of State’s Office to prepare a comprehensive voters’ guide for primary and general elections.

Steve Berch represents District 15, House Seat A. He is a member of the Education, Business, Local Government committees, and JLOC (Joint Legislative Oversight Committee).